Are you a First Time Homebuyer?

Congratulations on your decision to purchase your First Home. If you are still on the fence, try our Rent vs Buy Calculator to see if home buying makes sense for your situation. While exciting but buying your first home can seem like a daunting process. From mortgage rates to taxes to closing costs, there’s certainly a lot to consider. And because your new home will likely be the biggest investment of your life, it’s crucial that you educate yourself about the process before you get started.

The more you know about the homebuying process, the more likely you’ll be to get the home of your dreams at a price you can afford. That’s why we’ve put together these tips for helping you achieve your goal of homeownership.

Know what you want & where you want

When purchasing a residential property, you’ll have several options to consider. These include traditional single-family homes, condos, townhouses, and more. Each type of property has its benefits and drawbacks, so before you move forward, make sure you pin down which property type will best suit your needs. In addition to what you want, think about where you want. Just like properties have their pros and cons, so do neighborhoods. BAE Group is here to help you make these important decisions.

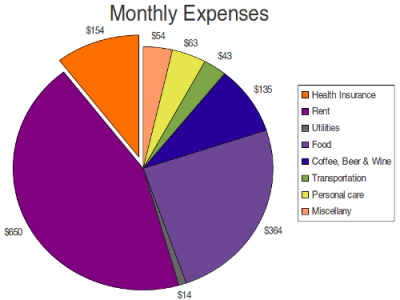

Look at total monthly cost

Mortgage payments are only part of equation. Before you buy, you’ll want to figure out what your total monthly housing cost will be, including homeowner’s insurance and taxes. BAE Group can help you estimate monthly costs.

Figure out closing costs

It’s important not to overlook the upfront cost of settling on your home. Closing costs include lender origination fees, taxes, title and settlement fees, as well as prepaid items like homeowner association fees and insurance. Again, BAE Group can help you estimate your closing costs.